In fact, you are getting answers to many of your questions just by opening a window in your browser and entering data into the car loan calculator. A car loan calculator is one of the tools which help conquer your goals. Such an approach helps to get a favorable loan and pay off your loan without burdening yourself. In fact, you will know all this even before you decide to find a branch, file a loan application, and commit to the lender. What is my monthly payment for a new vehicle loan Vs. What is the total interest amount on your loan, etc. What payment frequency works for you: monthly, bi-weekly, semi-monthly, etc. What financing options are offered and fit your financial situation What are your car loan payments under expected conditions To make a down payment or not to make it It helps to see alternatives and evaluate multiple car loan factors: Why do you need the CIBC car loan calculator? Therefore, while the results are mathematically correct, they should not be used as the sole basis for your financial and investment decisions.

Cibc loan calc professional#

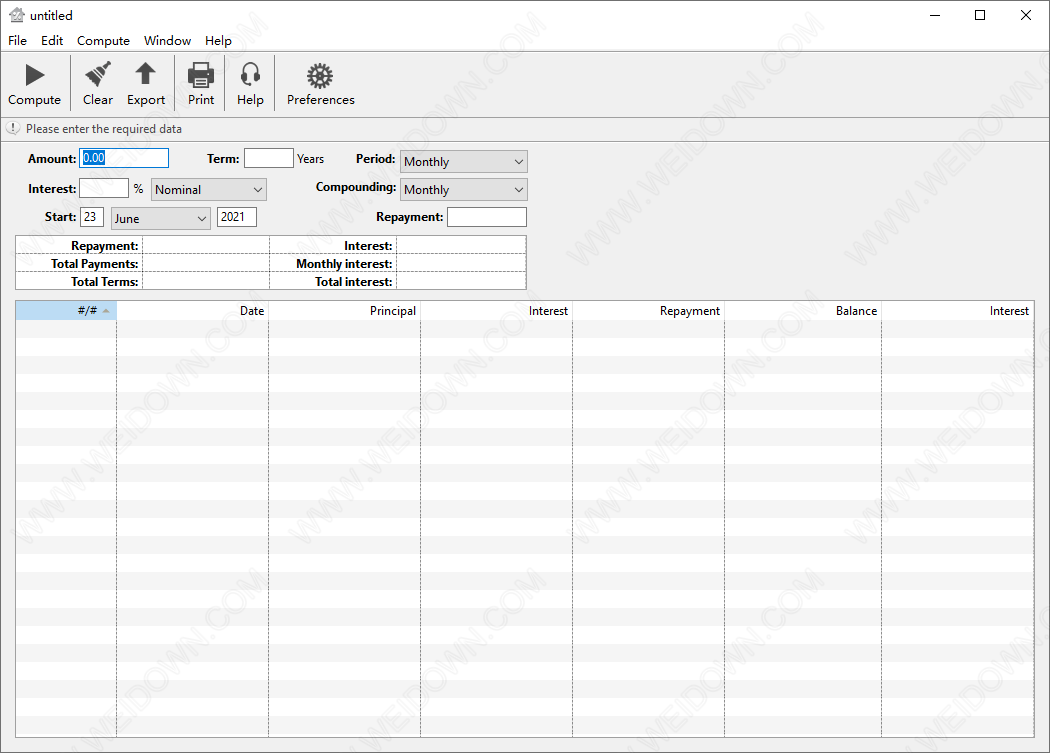

Reference! The auto loan calculator cannot replace professional financial advice, it cannot provide you with the information equivalent to an appointment with a bank loan specialist, and it cannot analyze your risk profile. To simplify this process, CIBS has provided a loan calculator that allows you to test your loan scenarios and see possible numbers and the impact of the loan on your budget.Īn auto loan calculator is an online tool that allows you to quickly calculate loan numbers with minimal effort on the borrower's part and maximum accuracy, thanks to the correct formula in the calculator. It is up to borrowers to decide which financing instrument is best for them.

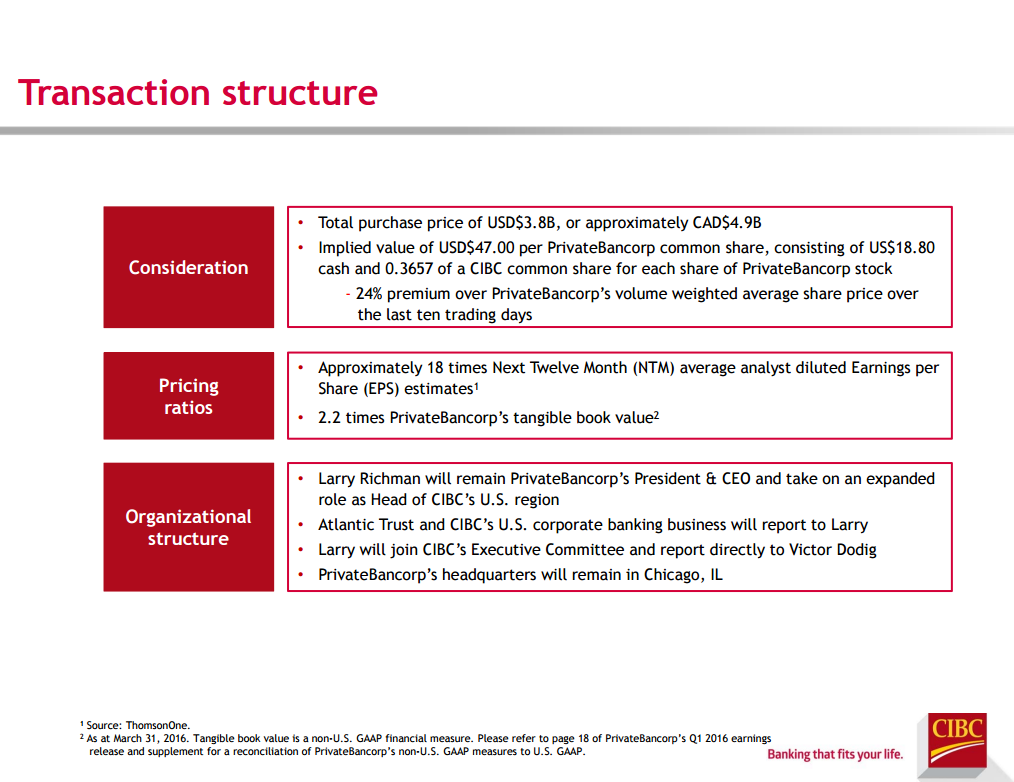

One of the types of loans is the car loan because the purchase of new or used vehicles is still popular.īuying a vehicle is related to the basic need to be flexible and independent to reach places when needed and when you want, without following the public transport schedule.ĬIBC offers three options for financing the purchase of a car:ĬIBC personal car loan, which is paid out for a specific purpose Ī personal loan that can be used for any purpose, including car purchase Ī line of credit can be used for various purposes, including car purchases. It offers a wide range of banking services, CIBC online banking, issues bank cards, CIBC Aventura Visa Infinite card, and various bank loans for businesses and individuals. Your iTunes Account will be charged when the purchase is confirmed.Canadian Imperial Bank of Commerce aims to generate value for its shareholders by producing consistent and sustainable earnings simultaneously, achieving strategic growth. You can go to your iTunes Account settings to manage your subscription and turn off auto-renew. The subscription will automatically renew unless turned off in your iTunes Account Settings at least 24 hours before the current period ends.

Cibc loan calc download#

So why wait? Download our loan calculator app now and start managing your loans like a pro.

With our user-friendly interface and powerful calculation capabilities, you can save time and money while staying on top of your finances. Whether you're a finance professional or someone looking to manage their loans more efficiently, our app is a must-have tool. Easy daily, weekly, monthly, & yearly calculations

Cibc loan calc pdf#

Easily choose the best loan option for your needs by comparing 5 loans at once and sharing your calculations as text or PDF files. With just a few clicks, you can calculate payments on a daily, weekly, monthly & yearly basis for up to 100 years by simply entering the loan amount & interest rate. Introducing the ultimate loan calculator app - the only tool you'll ever need for all your loan calculations.

0 kommentar(er)

0 kommentar(er)